|

THE GREAT RECESSION WAYS BANKS CONFUSE LOW INCOME CUSTOMERS INTO FEES

Just as banks began to struggle a couple years ago, they found a lucrative income source - the poor. And with the economy in recession, there has been no shortage in that class to pick on. In 2006, overdraft fees brought in an $18 billion profit for banks, a figure that rose to $24 billion in 2008 and an estimated $38.5 billion last year. Again, those figures are profit, after the risk. Countries have started wars for less money than that. There was a time banks generally either refused to cover overdrafts or did so for free as a service to sound customers. In the last decade, however, the practice changed and overdraft fees have doubled, even including an increase in the middle of the 2009 recession. The current median overdraft fee is $26, although if one just evaluates the larger Wall Street banks, the median is $33.

Of course, the larger the overdraft fee, the more likely it is

to reek havoc on one's bank account. In fact, banks count on the domino effect.

In a study released in 2008 by the FDIC, a quarter of those incurring an

overdraft fee were hit with additional charges. In fact, if a person withdraws

$20 beyond their balance from an ATM and is unable to pay it back for two weeks

- say, the maximum time for the next paycheck period - it is not uncommon for the

annualized

interest rate to exceed 3,500% on the advance. Some banks outsource the

service to third parties that advertise a 400% return on

overdraft fees.

With that kind of profit margin, it is not surprising that 70% of banks offering

overdraft protection will let customers withdraw money from an ATM and 89% will

allow a sales charge without informing them of insufficient funds.

Additionally, three quarters of banks automatically enroll

new customers in an overdraft protection plan and many of the

large banks will not let customers opt out.

For low income customers, the risk is ever present. A study by the

Center for Responsible Lending discovered that more than two-thirds of

overdrafts occur with people attempting to pay expenses that are unavoidable -

bills, transportation, housing, medical and food. Further, 8% had money deducted from their government aid, social

security, unemployment, welfare or veteran's benefits to cover the fees.

Here are four ways the larger banks will try to confuse customers into

fees:

1. The "Free" Checking Account

Years ago, major banks either required a monthly fee or a minimum

balance on checking accounts which meant most people living paycheck to paycheck

lost money when they put it in the bank, the fees far surpassing any paltry

interest they could earn.

That practice has been replaced by the free checking

account with supposedly no minimum balance required. This pitch makes it easier for sales reps to

gain new bank customers who might otherwise have searched for a bank with a more

lenient option but in reality there is a catch. A customer has to open

a savings account to accompany the checking and agree to allow an automatic

monthly transfer, usually $75, to the savings. The sales rep will tell customers

that it is to help them save money as if the bank had an altruistic about their

well being.

In actuality what this arrangement does is two things. One, it

allows banks to charge a fee when the customer does not have $75 to transfer.

The fee is not taken from the checking account, however. It is assessed to the

savings. If the customer hasn't put any money into the savings which is often

the case with a low income customer opening a new account, there is an

additional charge for each day the savings account remains in the negative due

to the fee. There have been widespread complaints that customers aren't informed

this when they open accounts and by the time the get the letter in the mail

notifying them, they have lost anywhere from $25 to $45. In some cases, such as

Wells Fargo, the letter will inform them the transfer did not go through but

will not notify them of the fee, prolonging the daily penalty being assessed.

Secondly, the transfer arrangement also adds confusion regarding

the checking balance. A person living paycheck to paycheck is going to need that

money bank in their checking account. If the customer forgets to transfer the

money back to cover a charge, the bank gets to assess a fee when it has to do

this itself.

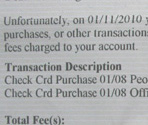

2) Pending Transactions

When a customer makes a purchase on their debit card, the transaction is not conducted

immediately, particularly when the purchase is charged. There is a stage where the funds are held on one's account, then a

stage where the money is actually transferred to the merchant a few days later.

This can be confusing when one checks their online

statement as the purchase initially will appear as a pending transaction and the

money is deducted from the

available balance. However, it is common for that charge to fall off a couple

days later, falsely raising the balance before eventually going through. Overdrafts

often occur as a result of people trusting the bank's accounting of what their

account balance is.

Banks claim this is just how their software works but

there are other people who will tell you the program can easily be changed.

3) Manipulation of Transaction Chronology

Pending transactions are also useful to banks when an

overdraft does occur. There was a lawsuit filed against Bank of America last

year when it was discovered, as is common practice in other institutions, that

the bank regularly shifted the chronology of transactions to be able to assess

the maximum number of overdraft fees. In other words, if someone made a $7

purchase in the morning and a $60 one in the afternoon and had only $50 in their

bank account when the day started, the bank put the $60 charge first so the

second also would fall into overdraft. Banks do the same thing with pending

transactions, which, although they assess it to a balance at the onset, they can

shift it and claim the charge was not completed until a few days later. So if

someone makes a purchase on Monday, another on Tuesday and a third on Wednesday,

the latter falling

When these fees are contested, most banks will overturn them but

even if six out of 10 people contest them, the bank still makes money on the

other four. Thus, it's a win-win policy for them. They aren't in violation of

the law because they can claim it was just a mistake and overturn it if contested but

if it is not contested, it's no risk profit for them. According to the FDIC, 54%

of larger banks do this customarily while less than a quarter of small banks do.

4) Check Delays

When a check is deposited that is drawn on a bank in the same

region it should take just two days to clear but almost everyone knows this isn't

always the case. In addition, an out-of-state check can take between nine to 11

business days to clear - meaning if holidays are involved it could total well

into the third week. In one study, 30% of customer who incurred overdrafts

claimed it was because of this.

The safest way to avoid overdrafts is to apply for a line of

credit, an option for those fortunate enough to be working these days or for

those who are

more financially solvent. This is essentially the same thing as the bank

offering a customer a credit card, meaning the bank allows one to go into the

red and pay later with interest. Of course, like credit cards, this encourages

the practice and creates debt, which is always lucrative to the loaner. Thus,

the only way for people on a tight budget to avoid overdrafts - unless they want

to spend hours every week being their own accountant - is to accept more credit.

With the current Move Your Money campaign, some have questioned whether moving

their $1,000 balance to

another bank will have much affect. These figures should erase those doubts. Just

like the credit card companies prefer those who don't pay on time, the Wall

Street banks compete heavily for the average Joe as much as the wealthy because

the $33 fees add up -- to nearly $40 billion.

|

Help a starving writer

to Wired Gypsy

The money powers prey upon the nation in times of peace and conspire against it in times of adversity. It is more despotic than a monarchy, more insolent than autocracy, and more selfish than bureaucracy. It denounces as public enemies, all who question its methods or throw light upon its crimes. I have two great enemies, the Southern Army in front of me and the Bankers in the rear. Of the two, the one at my rear is my greatest foe.. corporations have been enthroned and an era of corruption in high places will follow, and the money powers of the country will endeavor to prolong its reign by working upon the prejudices of the people until the wealth is aggregated in the hands of a few, and the Republic is destroyed. - Abraham Lincoln